Listening to the political pundits since the 2010 midterm elections, one would think little productive action is going to take place over the next two years in the halls of Congress. However, at RSES, we see indications that industry economic activity may continue to improve, regardless of the political leanings in Washington, D.C.

While RSES does not formally assess its members regarding their business activity or employment outlooks, we do glean a fair amount of anecdotal information from regular communications and informal surveys. While some of our technician members are still waiting for the proverbial “other shoe” to drop regarding their employment, the majority that we speak to are working regularly and some are even working regular overtime to keep up with their employers' workload.

Certainly some of that workload comes from contractors or facility managers managing the same amount of work with a smaller workforce (due to layoffs in recent years), but in speaking to contractors, the general feeling is that business will continue to improve in 2011. Much of that impression has formed over the past 30 to 45 days, when speaking to wholesale distributors and contractors about the newest RSES educational program focused on contractor business development.

Introduced to the HARDI membership during their 2010 Annual Conference, we have received significant interest in how RSES can partner with distributors to provide their contractor customers with a virtual blueprint for business. From building a personalized business plan to sales management and integrated installation/service with a customer-centric focus, with an option for ongoing consulting services, RSES is expanding beyond the technical arena in 2011.

A contractor's ability to manage its own business profitably has direct impact on a distributor's financial performance. Based on discussions we've had, distributors are anxious to help their customers improve their performance and are equally willing to invest in concrete programs designed to accomplish that goal. Again, it's not scientific, but reasonably strong anecdotal evidence shows that the market looks stronger next year if that important link in the supply chain is planning to invest in its customer base.

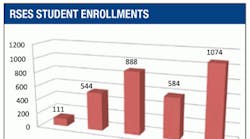

Similarly, RSES membership growth has surged in the student category. This is directly tied to growing interest in the skilled trades by workers displaced from other industries, as well as more young students who are choosing technical careers over traditional four-year college degrees in recent years. The dip in 2009 could lead one to believe 2010 will experience a similar dip but communication with schools and instructors in recent months makes us think student enrollment will continue to grow in 2011.

These impressions were echoed during the 2010 HVACR & Plumbing Instructors Workshop, sponsored by HARDI and RSES, along with nine other industry partners (www.instructorworkshop.org). At this workshop, held in Lansdowne, Va., instructors from secondary and post-secondary institutions shared recent experiences of demand being so high that they had to regularly turn away prospective students.

With large numbers of students entering the HVACR workforce, the long-lamented lack of knowledgeable technicians should start to abate. However, as any contractor will tell you, the additional preparation needed to transform those graduating students into productive installation and service technicians is not insignificant. This, too, bodes well, at least for RSES and other training organizations in 2011 and beyond; in addition to the hands-on experience provided by contractors, the newer technicians will need continuing education as well.

The third indicator that leads RSES to believe conditions in 2011 will continue to improve is demand for our publications. Preparatory materials for NATE certification exams have been our best-selling products for several years and demand has grown significantly over the last two years. For the 12 months ending October 2009, sales of our primary NATE manual grew 78 percent over the same period the previous year.

In October 2010, after replacing that single manual with a series of smaller titles covering the Core and four primary specialty exams, we're seeing more interest in these products. This series has seen a 261 percent jump in demand over the same period in 2009. We attribute a great percentage of this growth to an increase in training activities, in particular by wholesale distributors. A number of HARDI members have chosen to supplement their already impressive commitment to NATE testing by offering training classes to prepare candidates for those exams.

So although not “statistically valid” from a pure research perspective, the indicators at RSES are for a stronger 2011 from manufacturers, distributors, contractors, technicians, instructors and students alike.

Mark Lowry is RSES executive vice president. Contact him at 800/297-5660 x4051 or [email protected].