What is the value of your HVAC business? Business owners will commonly answer the question with the notion that their business is worth whatever someone is willing to pay for it. Unfortunately, whatever one person is willing to pay for anything is actually a price and not necessarily a value. In reality, the value of your business is determined by a calculation that is based on multiple characteristics and factors of your business. Additionally, your business may have more than one value, depending on what the valuation is to be used for.

One type of value is a “Fair Market Value”. For estate planning purposes, the IRS generally accepts a Fair Market Value. As defined by the IRS, the Fair Market Value of any business is:

“The price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, and both parties have reasonable knowledge of relevant facts”

What about a business valuation when you are in the process of selling your business and you must set expectations? Having realistic expectations is crucial in selling a business. Here again, a Fair Market Value is an excellent benchmark. Understanding the Fair Market Value of your business will help you successfully negotiate the price, terms and structure with a buyer. Without expectations set with an accurate valuation, the seller takes the chance of potentially selling his business for less than Fair Market Value or worse, walking away from what really is the right offer.

Is it possible for someone to offer more or less than the Fair Market Value? Absolutely, buyers acting with a compulsion or without the knowledge of relevant facts may pay more than Fair Market Value. This happens all the time; an example may be a buyer who is desperate to expand into your market for whatever reason. With this compulsion the buyer may offer a price that exceeds Fair Market Value.

The Value of What?

The differences between a valuation and an appraisal are often misunderstood by business owners. There are differences between a business valuation and a business appraisal. An appraisal is used to determine the value of the tangible assets owned by and used in the business and does not take into consideration intangible assets or earnings potential. It is important for business owners to have a solid understanding of what is a tangible asset and what is an intangible asset.

Tangible Assets: Assets that have a physical form. Tangible assets include both fixed assets, such as service vehicles, equipment, sheet metal equipment, computers, buildings, warehouses, land and inventory.

Intangible Assets: Nonphysical assets, such as customer lists, patents, trademarks, copyrights, goodwill, brand recognition, service agreement programs, advertising slogans and operating history.

Tangible assets can be touched and felt whereas intangible assets are non-physical. A business valuation is designed to determine the value of both tangible and intangible assets of which the latter is more subjective.

Steps in a Business Valuation:

There are specific steps required to be performed in a business valuation. The steps in a business valuation have an order, just like performing an air conditioning tune up. Your technician would not perform diagnostics on your clients HVAC equipment prior to establishing customer rapport and determining the age of the equipment. The steps to an accurate business valuation, in sequential order, are:

- Determine the purpose of the valuation

- Gather historical financial data

- Adjust historical financial data for extraordinary and discretionary occurrences

- Determine which valuation approach works best for the situation

- Calculate the Enterprise Value

- Apply balance sheet adjustments to the Enterprise Value

What is the Purpose?

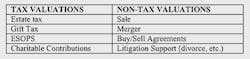

There are multiple reasons why a business valuation may be required. The reasons are typically divided into two groups; tax valuations and non-tax valuations:

Valuation for tax purposes can be more involved, as stricter guidelines must be followed. For this article, let’s assume that the intended purpose of the valuation is to determine a benchmark value for the sale of a residential HVAC service and replacement business – a non-tax valuation.

Historical Financial Information:

The basis of any business valuation is the historical operating results. Why are the financial results so important? The financial results are so important because all would-be buyers will be interested in future returns (profits) of your business. The single most reliable method of predicting future returns is by analyzing past performance.

What about your businesses potential? So many contractors want to base the value of their business on potential. Whose business could not be more profitable with a few more good installation crews, expanded marketing efforts or a better economy? Do not set your valuation expectations based upon potential. Buyers recognize potential and they plan to capitalize on your businesses potential. Potential is typically a motivating force behind a buyer and the buyer does not expect to pay for unrealized potential.

Gather your financial statements (income statements and balance sheets) for the last three full years. If you have five years of operating history, that is even better. A business valuation will consider multiple years of historical data, but will place a greater emphasis on the most recent information. For most scenarios historical financial results beyond five years old are not considered.

Adjusted Historical Financial Statements:

Chances are your historical financial statements will require adjustments before the true financial picture of the business can be understood. A common term for extraordinary and discretionary expenses on the historical income statements are “add backs." Common add backs include, but are not limited to:

- Excessive rent paid on real estate owned by the owner

- Excessive officer compensation

- Non-reoccurring expenditures

- Expenditures deemed to be “non-business” in nature

- Capital assets purchased and expensed

- One-time expenditures associated with business disasters

Knowledgeable buyers skeptically scrutinize all add backs offered by the seller. Add backs are subjective and can be over promoted when a seller attempts to report higher profitability to the buyer. This can lead to a seller having unrealistic expectations for the business. On the other hand, a seller who omits legitimate add backs might under value his business. Add backs are a crucial step in determining the true profitability of any business as very few have no adjustments required.

Selecting a Valuation Method:

There are three generally accepted valuation methods used to value a business. Each specific situation requires a certain a method. The methods are:

- Market Approach

- Asset Approach

- Earnings Approach

Market Approach:

If five very similar air conditioning contractors, all operating within your market, each sold for $500,000 within the last year, one could draw the conclusion that the sixth similar air conditioning would also have a value of $500,000. This sounds simple enough, but is it?

Gathering enough data to draw a sound conclusion can be difficult. Seldom are there enough relevant transactions within a reasonable time frame and of comparable size to offer a proper comparison. The Market Approach is used successfully in real estate, but has limitations when valuing small businesses.

Asset Approach:

The value of your tangible assets alone will not add up to an impressive final valuation. Sure, your fleet of vehicles and equipment has real value to a buyer, but in regards to the overall Fair Market Value of your business, these assets are only a few pieces of the puzzle! The remaining pieces are the intangible assets, most importantly the ability of your business to return a profit.

If your adjusted historical financial statements indicate the business is not capable of producing profits, or worse yet, its survivability is questionable, then the intangible assets have little or no value. In this case, the Asset Approach is used. Valuing an unprofitable business based upon the tangible assets involves determining the market value of all of the assets that are owned by the business. The Asset Approach commonly returns a low valuation when used to value contracting businesses with minimal tangible assets.

Earnings Approach:

The opposite of the Asset Approach is the Earrings Approach which is used to value a business that has demonstrated the ability to return profits and therefore has both tangible and intangible assets with value.

There are several different methods used to apply the Earnings Approach, all have the same premise — the value of a business is based on a factor applied to an earnings indicator (earnings stream) of the business. The most common factor is known as the “multiplier”. A multiplier is applied to an earnings indicator such as adjusted EBITDA, pre-tax net income or after tax net income.

A Word on EBITDA:

EBITDA or “earnings before interest, tax, depreciation and amortization” represents the cash flows generated through the operations of your business. EBITDA is used as an earnings indicator as buyers are commonly focused on generating enough cash flow to pay for the purchased business. When EBITDA is applied to a multiple, the result is the Enterprise Value.

A Word on Enterprise Value

The Enterprise Value of your business includes the following:

- Tangible assets used in the business

- Intangible assets of the business

Not included in the Enterprise Value are the values of such current assets and liabilities (referred to as working capital):

- Cash

- Accounts receivable

- Prepaid assets

- Accounts payable

- Deferred service agreement liabilities

- Warranty liabilities

- Current debt

The Enterprise Value of your business is not the final Fair Market Value as the working capital as well as long term debt must be considered.

The Earnings Multiple:

The earnings indicator is obtained from the adjusted historical financial statements and is less subjective than the earnings multiplier. Subjective as it may be, there are sound theories that go into formulating earnings multiples. A multiple represents an expected rate of return on an investment. Naturally, the higher the risk associated with the investment, the higher should be the expected return.

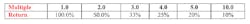

One way to compare the multiple to an expected rate of return is to divide the multiple by one as demonstrated in the table below:

Based on the above table, would a multiple of 10.0 be used to value a painting business? Most likely not, considering there are several safer alternative investments (stocks and bonds) that offer a 10.0% return with significantly less risk.

Expecting a 20.0% return, based on the risks of investing in any small service business, is as low of an expected return as a reasonable investor should expect. For this reason, that is why earnings multiples exceeding five times the earnings indicator are uncommon. With an expected return of less than 20.0%, a knowledgeable would-be buyer has better choices on where to invest his money.

Multiple ranges do vary and ranges should be taken into serious consideration when used to value a business. A slight increase or decrease in a multiple can significantly affect the overall Enterprise Value of a business. Assuming that a business reports a historical EBITDA of $100,000, the Enterprise Value would be as follows utilizing a range of different multiples.

In this example, for every ½ point added to the earnings multiple, the Enterprise Value of the business increases by $50,000! Determining the correct earnings multiple to use is subjective and involved. In order to make sure you are not under or overvaluing your business, consider seeking the advice of someone who not only has professional business valuation experience, but has industry specific knowledge.

Putting it all Together:

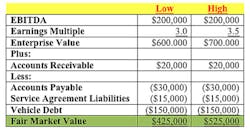

Assume your air conditioning business has an adjusted EBITDA of $200,000 and the correct range of earnings multiples is determined to be in the range of 3.0 to 3.5. Additionally, the business maintains $20,000 in accounts receivable, $30,000 in accounts payable and $150,000 of vehicle debt, the actual range of Fair Market Value would be as follows:

The Fair Market Value range of your business would be $425,000 to $525,000. This range of Fair Market Value gives full credit to the current assets and liabilities in your business. Buyers often expect that some amount of working capital remains with the business and, therefore, the Fair Market Value is adjusted to reflect the expected level of working capital.

Conclusion:

A common reason for a business valuation is to set expectations during the sale of your business. Entering into the sales process with an understanding of the Fair Market Value of your business will enable you to better negotiate the sales price, terms and structure with a buyer. Because a business valuation is not something done in routine, the steps outlined in this article should be carefully followed in order to ensure that the calculated value is accurate and reliable. An inaccurate business valuation is just as uninformative as no valuation at all.