Every company should have a defined exit strategy, from the very beginning, at start-up. As Steven Covey said “Begin with the end in mind,” and at some point every business owner will have to “exit, stage right.” So why not do it on your own, well thought-out terms? This seems to be a growing business imperative. This discipline will become the compass of directional success when incorporated with the annual business planning process.

Requirements for a Succession Plan

1) Business Valuation – a fair estimate of the company’s market value. This should be done, preferably by outside consultant — industry experts, accountant, attorney. The valuation should be updated at least every two years. Avoid multiple of revenue, EBITDA, or net profit; they can create false expectations for the seller. We recommend using discounted cash flow combining owner(s) disbursement(s) and net profit with adjustments for process integration, capital requirements, off-balance sheet assets with recurring revenue streams such as maintenance agreements and balance sheet assets.

2) A defined Business Model with integrated processes. This is all encompassing from a branding strategy, to the definition of the ultimate service call, dispatching steps, invoicing flow chart, data base management process, sales process, installation flow chart, troubleshooting process, HR process and the list goes on. Every aspect of business operations must be clearly defined. This is why franchises can almost guarantee success and have so much value.

3) Organizational structure, including defined, detailed role definitions for key decision makers and at what level and by whom decisions should be made. This is especially important in family businesses.

4) Involvement of professionals in the planning and after transition is complete– industry experts, CPA, financial advisor, insurance agent and attorney. And start a discussion with these professionals at a minimum of at least one year in advance of your planned exit. They will serve as the company’s” board of directors” going forward.

Situations Vary

Every business situation is somewhat different when it comes to the exit strategy. Some existing owners want to walk away and never look back. Some want to stay minimally involved to ensure the future success and their pay-out. In some cases, new ownership wants current ownership completely out of the business for various reasons. Exit strategies also vary according to who is buying the business: is it family? Is it a key employee or employees? Is it another company? Each of these situations creates a somewhat different approach.

Case Study: Long Term Planning Works

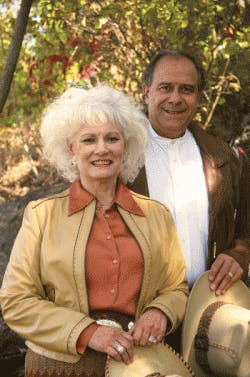

An example of one approach where the business is being transferred to family members is Illiana Heating and Air Conditioning, Inc., Cedar Lake, Ind. This is a Christian-run business with strong family relationships. The current owners are Tom and Sue Krygsheld, aged 55, with three children. The company was started in March, 1987. To begin the succession process, Sue retired from the business on January 1 2014. In 2015, the company generated $4 million in revenue with a healthy bottom line and 18 employees.

“John and Vicki have been instrumental in making sure we were successful and making money, with correct financials, and all the correct benchmarks,” Tom says. “They’ve been not only good business counselors, but awesome friends. I’ve never had trainers who virtually become part of your family, who you can talk with regularly.”

As Tom Krygsheld counseled with John and Vicki LaPlant, these five succession goals became paramount:

1) Be rewarded for the business that he and Sue have built.

2) Be unencumbered with the day-to-day decisions and long-term strategy.

3) No negative impact on close family relationships; all three children and their families are treated fairly; open discussion during the planning with all children involved.

4) Have a comfortable retirement, leave the business and personal finances debt free, and continue tithing and gifting back to their church and community.

5) Minimize personal tax consequences.

The value of the business was placed at $2.5 to $2.75 million. When implemented in the spring of 2016, the new ownership structure consists of three owners: Tom’s son, Dan who is the sales / installation manager and lead salesperson will receive 34% of business, Tom’s son-in-law, Kevin who is the general manager and his wife, Tom and Sue’s daughter Wendy, will receive 34% of the business and Tom and Sue will retain 32% of the business. The other child, Mandy, is becoming a minority owner in a separate business owned by Tom and Sue. This total transition is not a sale but a gifting to the children. The new majority owners, Dan and Kevin, are purchasing “key man” insurance to protect the assets of the business. The company is also purchasing larger liability insurance for the business.

Financial Guides and Friends

Tom Krygsheld adds that over a seven-year span of time, the relationship with John and Vicki has contained everything a business owner could want from a qualified counselor.

“John and Vicki have been instrumental in making sure we were successful and making money, with correct financials, and all the correct benchmarks,” Tom said. “They helped us to train Dan and Kevin when they entered the business. They’ve been not only good business counselors, but awesome friends. I’ve never had trainers who virtually become part of your family, who you can talk with regularly.”

Tom’s work in steering this ship into port with the LaPlants is supplemented by close counsel with his CPA and attorney.

“Start very early,” he says, “and understand the talents of those who are working in the business. My son is great in sales, and my son-in-law has the management and financial ability we need. You need to know the gifts of your children. Don’t just put them into positions they’re not gifted in, because you will fail.”

Most business transitions do not go as smoothly as this one has. The key to its success has been long-term planning, involving professionals and a genuine concern for the success of the next generation and the long-term success of the business.OR, YOU CAN DO NOTHING

Business consultant Brandon Jacob, president of ContractorsCFO, finds there to be a very clear distinction between those business owners who plan ahead for retirement and those who don’t. Sadly, he finds the universe of forward-thinking business people who plan for the future to be very small.

“I wish the majority of my business was in helping a handful of contractors prepare their businesses for sale. And by that, I mean helping them plan a real exit strategy — where I can work with an owner for six-months to up to three years, on a quarterly or monthly basis. Very few of them will do that. It’s a very difficult sell,” says Jacob, a consultant with 23 years of experience in business valuations, mergers and acquisitions, profit improvements, finance and accounting. His new book, "Operation Exit Strategy," is a guide on how to formulate a successful exit strategy. "Operation Exit Strategy" covers “mission critical” areas that must be addressed to craft a successful exit from your business.

Hiring an expert with Jacob’s years of business planning experience is essential to a contractor’s successful succession strategy.

“The ones who get it and have participated in the full counseling package I offer have sold their businesses for millions of dollars. The ones who roll out of bed one day and decide to do it on their own are being slaughtered,” he says.

Jacob warns that time is of the essence for HVAC business owners who think they might want to sell their businesses over the next three to five years, because it’s becoming more of a buyer’s market.

“This industry and all industries will be filled with more baby boomers who will want to sell their businesses. The amount of capital in all industries will result in a buyers’ market,” he says. This is where the all-important first step comes in: timing.

“It’s scary to talk to a 62-year old business owner who is still ‘having fun’ running the business,” Jacob says. “Well what will he do when he’s not having fun at 66, and he tries to sell the business, and the buyer says, “since you’re not staying on, I’m going to discount my purchase price significantly. There will be massive amounts of that going on. If you’re not involved in some type of exit strategy right now, and you plan to sell within the next five years, you better get off your butt and start thinking about it,” Jacob says.

He adds that a business buyer will look for five things:

- ability to demonstrate consistent earnings

- a manager who will stay on after the business is sold

- quality service agreements

- revenue and market area

- presence of established brands.

“The ability to demonstrate earnings, understand the value of your business, and to dedicate some time to getting your business right before putting it out there is critical,” Jacob advises.

contractorscfo.com / operationexitstrategy.com