PSMJ: August Commercial Project Proposals Flat, but Steady

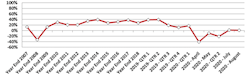

NEWTON, Mass. – Overall proposal activity growth remained essentially flat in the month of August, indicating that the architecture, engineering, and construction (A/E/C) industry has moved beyond the record-setting lows seen in the 2nd Quarter. After plummeting to a worst-ever -41% in April and -22% for the full 2nd Quarter, the overall Net Plus/Minus Index (NPMI) in PSMJ Resources’ Quarterly Market Forecast (QMF) survey rebounded to +2% in July and stayed relatively flat at +1% in August.

The data shows a struggling education market, tying for second-worst among the 12 major markets with an NPMI of -29%, a slight dip from -26% in the July survey. Education has been lagging in the QMF for months, recording the lowest score among the 12 markets in the 4th Quarter of 2019 as well.

After dropping to -19% in the 1st Quarter and -27% in the April supplemental survey, Housing’s NPMI has climbed steadily,

While the Healthcare market recovered enough to regain the top spot among the 12 major markets surveyed with an NPMI of 31%, and the Energy/Utilities sector grabbed second (29%), it was the Housing market’s performance that impressed analysts the most. After dropping to -19% in the 1st Quarter and -27% in the April supplemental survey, Housing’s NPMI has climbed steadily, reaching 27% in August (up from 15% in July and 2% in the full 2nd Quarter). Nearly half (45.8%) of respondents said that Housing proposals grew from July to August, while only 19.3% reported a decrease.

“I conditioned this on the assumption that the health crisis would be behind us and, to a lesser degree, on movement on an infrastructure plan,” says Burstein. “Interestingly, we’re still in the midst of the crisis and the infrastructure plan hasn’t budged, but the housing market has bounced back impressively, even exceeding pre-COVID levels.”

Healthcare, which was a top performer for the past several years, dropped into negative territory in April for the first time in the survey’s 17-year history when it fell to -8%.

The Commercial markets, which Burstein expects to recover by the late 3rd Quarter or the 4th Quarter, have not yet turned the corner. Among the 12 markets measured in August, Commercial Users (-36%) and Commercial Developers (-29%) lagged the field.

PSMJ Consultant Greg Hart, who manages the QMF, says Commercial markets appear to be a victim of the uncertainty that COVID brings. "This pandemic has accelerated the move away from bricks-and-mortar retail toward online retail. And renters of office space are now looking at permanent reductions in square footage as they allow more employees to work from home."

Healthcare, which was a top performer for the past several years, dropped into negative territory in April for the first time in the survey’s 17-year history when it fell to -8%. The dip was likely caused by the diversion of most healthcare-related resources to combatting or preparing to confront the COVID surge. With the situation under somewhat better control, and the enemy much more understood, normalcy seems to be largely returning to the Healthcare sector.

Water/Wastewater, which PSMJ said has not been hit by COVID as have other markets, held its own in August with a 20% NPMI, which positioned it as 4th-best, ahead of Heavy Industry and Environmental (both 9%). Only the Commercial markets are performing worse than Education in 2020. The other markets assessed were Light Industry (0%), Transportation (-3%) and Government Buildings (-6%).

The August supplemental survey did not include questions about the 58 submarkets measured in quarterly surveys. PSMJ’s QMF has been a solid predictor of construction market health for the A/E/C industry since its inception in 2003. A consistent group of over 300 firm leaders participate, including 155 responding for the August supplement.