This is how JP Morgan Equity Research distinguishes between AHRI Unitary Shipment reports and HARDI's Monthly Sales TRENDS Reports. Shipments are "sell-in," while HARDI member sales are "sell-through." I believe rightfully so, we've found JP Morgan devotes more attention and analysis to "sell-through" than most of their consultant and analyst counterparts. However, right now, we have to consider a vast array of factors if we hope to come anywhere close to understanding what's actually happening in terms of residential and light-commercial unitary equipment sales. Repair vs. replace, inventory levels, new construction forecasts and, once again, refrigerant type considerations must all be carefully evaluated when trying to determine why, for example, AHRI unitary shipments dropped a percent while HARDI member sales grew 15 percent. Undoubtedly, this additional layer of analysis, finally taking into account distributor activity, has bolstered industry forecasting by members and manufacturers who realize the value of such data and what it could ultimately mean to their businesses. That being said, it's still not clear enough what is actually happening month in and month out with unitary equipment sales … at least not yet.

There are few correlations with much of anything to use heating equipment sales as a leading indicator of industry or distributor growth. They are smaller ticket, relatively less-discretionary products with less variance in options, features and other characteristics when compared to split-system cooling equipment. Do not, however, interpret this as diminishing the value of furnace and boiler sales, but cooling equipment is a better leading indicator, providing our distributors with grounds for more fact-based or knowledgeable purchasing and sales strategies. AHRI's Unitary Shipment report provides a national aggregate of cooling equipment shipments broken down only between central air conditioners and heat pumps, and by capacity. This gives no insights into mix shifts in sales by efficiency level or the equipment's design by refrigerant type. In 2011, these two factors will have the most direct impact on equipment distributors' profitability, yet to date in our industry there has been no aggregated tracking of such information that all HVACR distributors could see. I am proud to announce that this is about to change.

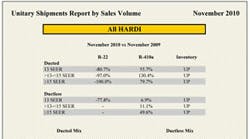

HARDI's new monthly Unitary Distributor Sales Report is the industry's first to provide a unitary sales breakdown for cooling equipment by efficiency level and refrigerant type segmented between ducted and ductless systems. Further, this new, regionalized report allows HARDI distributors to truly benchmark unitary sales performance. Just imagine how powerful this information would have been with an historical baseline in place before the massive expansion of the 25C residential tax credit in 2009, or at the beginning of the regulatory phaseout of R-22, or better yet before the 2006 shift to 13 SEER minimum standards. Admittedly, HARDI and many of our members should have been tracking this kind of information for the last decade, but since we can't go back in time, let's focus on creating a new reporting standard and distributor tracking processes that will serve us well into the future. If any distributor member who sells unitary equipment (which would be about three quarters of the HARDI distributor membership) does not have his or her mind racing at this point with potential uses for this kind of data within his or her business, I urge you to call me directly at 614/345-4328 ×24. Obviously I'm having a tough time checking my enthusiasm for this new report.

For the rest of you, of course, I welcome your calls as well, but let me provide a few thoughts on exactly how valuable this information could be to your company and address some of the challenges you may find when you begin reporting this information. I see immediate values of this new report aligning with the four major questions for 2011's equipment market:

-

Mix Slide: 2010 was bolstered by an historic percentage of high-efficiency system sales. This year, 2011, won't be about if that percentage will slide, but by how much. No other aggregated data will tell you this but ours.

-

R-22 “Dry-Shipped” Impact: Again, the question isn't whether there will be an impact, but rather how big will it be? There is no uniform forecast for this market's size in 2011 (though HARDI will be presenting one in mid-February), and while AHRI will include these units in their shipment reports this year, it certainly won't be regionalized and may not segment the information at all.

-

Repair vs. Replace: Granted, we aren't ready to collect and track distributor compressor sales yet, but by capturing distributor unitary sales, we will have a more reliable aggregated data baseline from which to work. This ties back to No. 2, because a huge question for 2011 will be what percent of replacement compressor sales are converted to dry-shipped condensing unit sales.

-

Regionalization: While government and efficiency advocates think only in terms of regulating and mandating unwise and unnecessary regionalized standards for unitary equipment, there's a dearth of aggregated regionalized sales data available to most distributors. For example, most of the country experienced record heat in 2010, while the West and Northwest suffered through unseasonably cool temperatures. What many perceived as a potential boom year for cooling equipment sales in early 2010 masked a brutal year for much of the West. Understanding to what degree those regions lagged would have been powerful information.

Page 2 of 2

Being the first month of reporting, we based the data on an 8 percent response rate from HARDI equipment distributors. Our goal is for that number to be 50 percent by June 2011. After showing you the depth of information delivered in this report, contributing or providing your unitary sales data should be the greatest “no-brainer” of 2011. This reporting, however, will probably not be easy for many equipment distributors.

Arguably the greatest benefit this new report will provide to our equipment distributors will be providing them with the impetus for distributors to more closely track their equipment sales. I've spoken to a number of members about this new reporting resource already, and nearly each one expressed a) how hard it was to pull the data the first time and b) how this type of data should have been tracked since the shift to 13 SEER.

As anyone who knows me or has heard me speak will attest, I am passionate about the value HARDI distributors provide our industry: They are the best in the business. However, I must admit that I was shocked and a little discouraged upon learning that few distributors had been tracking unitary sales by efficiency level and refrigerant type. Subsequently, I struggle to understand how one who does not track this information could make profit-maximizing purchasing and sales strategy decisions, especially given the impact of 25C tax credits over the last two years on sales of the highest-end systems. The good news … it will only take some teamwork with senior management, including a unitary product manager, sales leadership, the inventory manager and a few concentrated hours of isolating the necessary SKUs, to contribute to the Monthly Unitary Distributor Sales Report. The hardest part for most will be capturing previous year sales by unit volume. As Nike famously said, "JUST DO IT!" This short investment of time and resources will provide you with what I am convinced is an invaluable forecasting tool; and once you've built the reporting process, you can easily pull, report and review this data each month. I have spoken to several distributors that have gone through the process and I would be more than happy to connect you to a noncompetitor member willing to share the process they implemented. I believe this information is that important. The management benefits to having this higher level of benchmarking are indescribable. Without sounding too hyperbolic, HARDI exists to identify needs like this, develop the solutions and produce the tools designed to provide you with a tangible competitive edge.

Once you've established a reporting process and assigned a primary and secondary person to receive and respond to reporting requests from [email protected] every month, I urge you to reach out to your fellow HARDI distributors selling the same equipment line. You should be coordinating efforts to report as a unified group. Imagine the change in dynamics at your next Distributor Advisory Council meeting or your next annual supplier review when you base discussions on aggregated and regionalized distributor data.

As participation in the Monthly Sales TRENDS Reports has grown, we've seen an interesting dynamic form as anecdotal sense about the market more frequently diverges from the hard data. I believe this may be even more prevalent in the unitary sales market. Each month, HARDI's board of directors reviews a draft of the Monthly Sales TRENDS Report from ITR to "sniff test" the numbers for each region. If a director thinks the report for his region doesn't align with their sense of how their region fared that month, then we ask ITR to re-examine the data. Each time this has happened, the data proved reliable, leading several directors to re-evaluate how they judge performance in their respective regions. That is the essence of benchmarking and why it is one of HARDI's four strategic pillars. Equipment distributors finally have a golden opportunity to make purchasing and strategic decisions on reliable, third-party, peer-based data that will either reaffirm or perhaps challenge some traditional, anecdotal assumptions. “Sell-through” is the key metric for our industry and through HARDI distributors is the only proprietary way we'll be able to capture it. While perhaps one of the most over-used terms, this new Monthly Unitary Distributor Sales Report is by all measures a legitimate GAME CHANGER … as long as HARDI equipment distributors support it.

HARDI's new Monthly Unitary Distributor Sales Report is the latest addition to the Targeted and Regional Economic News for Distributor Strategies (TRENDS) program provided as a member benefit through collaboration with Alan Beaulieu, HARDI's chief economist, and the Institute for Trend Research (ITR). Only ITR receives member-reported data, and HARDI's staff and leadership have no knowledge of which member companies report. HARDI distributors must “white-list” the e-mail address, [email protected] to receive all TRENDS reports, Quarterly Forecasts and monthly reporting forms. Distributor members with questions about the TRENDS program should contact HARDI at 888/253-2128. Supplier members can subscribe to the TRENDS reports and forecasts (with the exception of the new Unitary Report for the time being) by being a Premier or Sustaining Member, or subscribing separately. Contact HARDI for more information.

Talbot Gee is the executive vice president and COO of HARDI. Contact him at 888/253-2128 or at [email protected].