Understanding and Enhancing the Value of Your HVAC Company

Is your HVAC business looking to secure bank financing, pursue strategic growth through a merger or acquisition, or considering an exit? Whatever your current goal, understanding and enhancing your company’s value is essential for long-term success.

Following is a comprehensive look into the factors that drive value for both residential and commercial HVAC companies as well as many other service businesses, including plumbing, electrical, roofing, and general contracting companies. Knowing what makes your company valuable will not only improve daily operations but also enable you to benchmark your performance against industry standards, negotiate better terms for financing, and make informed decisions about a potential buyout or sale.

Residential HVAC Value Drivers

As a residential HVAC company, you operate in a dynamic market influenced by technological advancements, changing consumer preferences, and regional trends. By considering the three key factors listed below and how they affect the value of your business, you can start identifying ways to increase your company’s worth.

1. Market Demand and Growth Trends. Evolving consumer preferences and technological advancements—including smart thermostats, energy-efficient heat pumps, and integrated HVAC systems—have spurred significant growth recently in the residential HVAC industry. As homeowners increasingly prioritize energy efficiency and smart home integration, HVAC companies that adopt cutting-edge solutions like these are better positioned for success. By offering maintenance plans and high-quality service along with these innovations, your company can capitalize on higher demand and charge premium prices.

Market dynamics such as seasonal fluctuations and geographic location also play critical roles in shaping demand for services, which in turn influences your company’s valuation. The demand for HVAC services tends to peak during summer and winter months due to temperature extremes. Furthermore, companies in regions that experience climate extremes or are facing rapid population growth (such as the Sunbelt) typically see higher valuations. As the chart below indicates, industry revenue is increasing even as energy usage has decreased due to the introduction of the Nest Learning Thermostat (the first major smart thermostat that could learn user habits and automatically adjust temperature settings) in 2011 and AI-driven HVAC management (which enhances predictive systems for temperature control) in 2018.

Business owners who explore and understand these trends can take advantage of them to enhance market position and their company’s overall value.

2. Revenue Streams. Diversifying revenue streams is crucial for the long-term stability and growth of residential HVAC companies. By tapping into multiple sources of income, you can safeguard your business against market volatility and increase its overall value.

Service contracts are among the most valuable, reliable, and profitable sources of income for residential HVAC businesses. These contracts provide consistent cash flow and reflect strong customer loyalty, making the company more appealing to prospective buyers or investors. Furthermore, when you decide to sell your residential HVAC business, having a defined service department with auto-renewing service contracts can drive value to higher multiples.

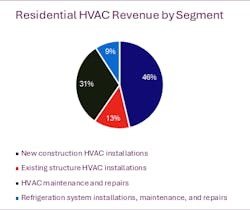

Establishing contracts with new home builders at a healthy profit margin can generate significant revenue, not just through system installation but through service contract offerings for the new homeowners. This income stream can be seen as being less predictable, however, as it is closely tied to economic conditions and fluctuations in the construction market. The pie chart below shows that new construction installations make up the majority of revenue for residential HVAC businesses. While a concentration of this revenue at a low profit margin can devalue your business, using it as a step to growing service can increase profitability and improve the overall value of your residential HVAC business.

Your HVAC company can also expand its service offerings with related services such as electrical work, plumbing, or insulation. Homeowners value a one-stop shop so they can avoid juggling multiple providers. This diversification can help stabilize your revenue and enhance your business’s overall value by creating customer loyalty and mitigating the effects of seasonal demand changes.

3. Operational Efficiency. When you’re aiming to improve profitability and business value, maximizing operational efficiency is a must. Efficient operations drive financial performance and can help your HVAC company stand out in a competitive market. Controlling job costs, delivering a high level of customer satisfaction, and completing jobs on schedule—and within budget—raises the likelihood of your success compared with competitors.

Some of the most valued—and valuable—HVAC businesses have implemented daily stand-ups with their team to set goals and reflect on overall performance in order to ensure success. As a business owner, you should monitor key performance metrics such as labor utilization, job completion times, customer satisfaction scores, and profitability per project to ensure continuous improvement.

Additionally, by investing in technician training, safety, and certifications, you can enhance your company’s service quality, reduce errors, and increase both technician loyalty and customer satisfaction—all of which will add value to your residential HVAC company.

Commercial HVAC Value Drivers

Commercial HVAC companies operate in a different environment from residential firms, often dealing with larger-scale projects, more complex systems, and longer-term client relationships. The same three factors drive value in commercial HVAC businesses, although how they do so reflects these differences.

1. Market Demand and Growth Trends. Robust growth among commercial HVAC businesses is fueled by several key market trends, from infrastructure and technological upgrades to the push for sustainable solutions, that are shaping the future of the industry. Infrastructure improvements, the growing need for energy-efficient systems, and the modernization of older buildings are stimulating the demand for new or updated commercial HVAC systems (see chart below). Furthermore, the increasing focus on sustainable building practices is driving demand for advanced technologies, including HVAC controls that improve efficiency and provide building managers with data-driven solutions for their commercial buildings.

Meanwhile, as governments and private companies invest heavily in infrastructure, sectors such as healthcare, education, and public administration are expected to increase their demand for modern HVAC systems. Taking advantage of opportunities related to these large-scale projects can raise your company’s valuation, as long as you are smart about growth and remain focused on quality and profitability. Commercial HVAC businesses that serve a diverse range of industries can further benefit from greater stability and value. Diversifying across sectors helps mitigate the risks of economic downturns in specific industries, providing steady income from various sources while adding variety to your customer concentration.

As sustainability becomes a greater priority for many businesses, HVAC companies that offer green solutions—such as energy-efficient retrofits or systems qualifying for Leadership in Energy and Environmental Design (LEED) certification—are in high demand. Helping your clients achieve energy savings and sustainability goals will position you to thrive in the evolving market.

2. Revenue Streams. A diversified revenue model is essential for the success of your commercial HVAC company, with several key streams contributing to financial stability and long-term growth. Long-term maintenance agreements, for one, are crucial for commercial HVAC businesses because they provide dependable, recurring revenue. These contracts also can make your company more attractive to buyers or investors seeking stable cash flow.

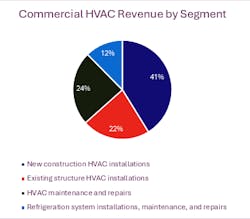

Does your commercial HVAC firm balance revenue between new construction projects and replacement or retrofit work? While new construction can be lucrative and, in fact, accounts for the majority of commercial HVAC revenue (see pie chart below), replacement and retrofit jobs often provide more consistent and predictable demand. What’s more, working directly with building owners is likely to result in higher margins for your company. Owner-direct contracts allow for greater control over project terms, timelines, and pricing, offering more flexibility than working under a general contractor.

3. Operational Efficiency. As a commercial HVAC company owner, you know that having defined operational strategies can significantly enhance efficiency, profitability, and overall business value. Monitoring specific metrics is equally essential to improving operational efficiency; so to ensure smooth operations and identify areas for improvement, be sure your company regularly tracks project completion times, cost overruns, equipment downtime, project profitability, and technician productivity.

Having your technicians obtain specialized certifications in fields such as medical gas installation and service or stainless steel piping can also boost your company’s value as you take on more complex, higher-margin projects and service offerings that lead to customer retention and recurring revenue. Other technician certifications, such as Building Performance Institute (BPI) certification and LEED accreditation, can keep your technicians engaged while making your company the contractor of choice when building managers look to upgrade in line with clean energy initiatives. These qualifications and certifications also signal to potential buyers and investors that your company has the expertise required to handle specialized work and can flex into installing and servicing the latest building technologies and innovations.

The composition of your workforce, whether unionized or non-union, also plays a role in both your company’s operational efficiency and costs, which in turn will impact the pool of investors and buyers interested in the business. A unionized workforce often is able to adjust to a changing workload and number of projects, and may offer various skill levels that can be strategically implemented based on customer or project needs. While unionized employees often require higher wages, they can bring specialization and training that can improve project quality and enhance client satisfaction, generating greater profitability for your company. Whether buyers and investors place a higher value on unionized or non-unionized companies depends on the circumstances and what the investors are looking for.

Enhancing the Value of Your Residential or Commercial HVAC Company

When considering how to increase the value of your HVAC company, whether your focus is commercial or residential, several key areas come into focus that are critical for operational success—and for showcasing your business’s worth to potential investors, buyers, or financial institutions.

1. Management Team, Back Office, and Culture

A strong management team is the backbone of any business, and HVAC companies are no exception. Investors, buyers, and lenders look for companies that display competent leadership, clearly delineate roles and responsibilities, have dedicated employees, and evidence a well-structured administrative function. An efficient back office ensures smooth operations, proper handling of contracts, and effective customer management—all of which contribute to a positive company culture and thus to the overall value and success of the company.

Consider the following elements that affect the valuation of your company:

- Leadership Style. Effective leaders communicate effectively and have well-honed problem-solving and decision-making skills. They can inspire and motivate their teams while fostering a positive work environment.

- Culture. Having a strong company culture where goals are set and then celebrated when achieved goes a long way to supporting employee loyalty. HVAC technicians (and all tradespeople, for that matter) are in high demand because they are imperative to the growth and sustainability of your business. Having access to the tools they need, appropriate safety programs, and growth-focused compensation can help build employee satisfaction and loyalty.

- Industry Expertise. A management and support team with deep industry knowledge and experience can navigate industry advancements and trends, anticipate challenges, and respond effectively to changing market conditions, delivering superior value for your company and ultimately your customers.

- Technology Adoption. Embracing technology in vital business areas such as finance and accounting, customer relationship management (CRM), project management, and field service management can improve your company’s efficiency, streamline operations, and enhance customer and employee satisfaction. Integrating these systems to produce meaningful key performance indicators (KPIs) can also drive value.

2. Financial Reporting and Forecasting

Any potential buyer or financier interested in your HVAC company will evaluate its financial health first, looking for accurate and detailed financial reporting, solid bookkeeping practices, and the ability to forecast performance. If your company can demonstrate consistent profitability and provide monthly financial projections based on solid data, it will appear far more valuable in the eyes of investors. Here’s what buyers and others will primarily consider:

- Accuracy and Transparency. Ensure your financial statements are accurate, consistent, and transparent, including adherence to best practices overall and generally accepted accounting practices (GAAP) where feasible. For commercial HVAC (or any business that relies on project-based contracts), follow monthly work-in-progress (WIP) accounting, adhere to a monthly closing process, and generate monthly internal financial statements. Having a compilation, review, or audit conducted by an external CPA firm based on the size and complexity of the business is highly recommended.

- Financial Modeling. Utilize financial modeling tools to create realistic projections and assess the impact of different business scenarios. Regularly review projections with the management team while tracking and evaluating whether and to what extent the company achieves these projections.

- Tax Efficiency. Optimize your tax strategy to minimize tax liabilities and maximize profitability. Careful tax planning with an experienced tax advisor can help you determine the best structure for the business based on your future plans. Doing so in advance of any major transaction will maximize the options available to you.

3. Strategic Growth Plans

HVAC companies with a clearly defined growth plan are inherently more valuable than those that lack such a plan. Whether your company plans to expand into new markets, offer additional services (like plumbing or electrical), or increase market share through one or more acquisitions, having a documented strategic plan for growth signals to buyers or investors that your company is forward-thinking and capable of long-term success. Be sure to consider the following:

- Market Research. Conduct thorough market research to identify growth opportunities, assess competition, and understand customer needs.

- Diversification. Consider diversifying your revenue streams by offering additional services or entering new markets to reduce reliance on a single source of income. If you are heavy in projects or new construction, consider adding a service division or a maintenance plan for your customers. Investors and buyers find a diverse revenue mix that includes recurring revenue to be highly valuable and much desired. Review your customer mix; if more than 20% of your revenue is concentrated in one customer, contemplate strengthening your business development efforts in other areas.

- Partnerships and Acquisitions. Explore strategic partnerships or acquisitions to accelerate growth, gain market share, or access new technologies. Developing a clear list of businesses that you would want to partner with or acquire adds value to your business; it also offers potential lenders a way to understand your plan for growing the business and positions you in a more desirable light if you are looking to stay on and grow the business with a new owner.

4. Condition of Assets (Leased vs. Owned)

The assets your company owns, such as vehicles, equipment, and buildings, are key components of its valuation. Owned assets, particularly those in good condition, add value by reducing ongoing operational costs; they can also be used as collateral if you seek financing for growth initiatives. Leased assets, on the other hand, might not contribute as much to a company’s overall valuation, but they offer flexibility and frequent turnover, which can ensure that customer-facing assets are well maintained and in overall good condition. Keep the following tips in mind:

- Asset Management. Implement a comprehensive asset management plan to track, maintain, and replace assets efficiently.

- Depreciation. Accurately calculate depreciation to reflect the decline in value of your assets over time.

- Lease vs. Buy Analysis. Evaluate the financial implications of leasing versus owning assets to determine the most cost-effective option for your business.

Maximize Your HVAC Company’s Value

The value of your HVAC company, whether residential or commercial, is influenced by various factors, including market demand, operational efficiency, workforce and culture, and financial health. Today’s residential HVAC companies are benefiting from growing interest in energy efficiency and smart home technologies, while commercial HVAC businesses can capitalize on infrastructure investments and green initiatives. Either way, to maximize your company’s value, focus on diversifying revenue streams, maintaining a highly skilled workforce, and improving operational efficiency. With these strategies in place, your HVAC company will be well-positioned for smart growth, whether through organic expansion, bank financing, or a merger or acquisition.

Nicole Kiriakopoulos is the Director of Investment Banking, Mergers & Acquisitions at PCE Investment Bankers, Inc. pcecompanies.com