A new survey of HVACR contractors by Emerson Climate Technologies, taken to evaluate contractor readiness for the 2010 phase-out of R-22 refrigerant, reveals some alarming statistics:

•13% of contractors surveyed reported that they are exclusively quoting R-410A

• 69% reported that they currently quote both R-410A and R-22

• 11% are not offering R-410A

• 40% admitted that they intend to wait until 2010 to convert their sales to R-410A equipment.

Many industry observers could have guessed that such a survey would produce some dismal findings, and simply chalk it up to the usual human tendency to wait until the last minute. However, where refrigerants are concerned, the ramifications of procrastinating will be much more serious than simply waiting until Christmas Eve to start your holiday shopping.

The demand for R-22 refrigerant in the U.S. continues to grow, both for the original equipment production and for the service of existing equipment. By delaying their recovery and reclamation efforts, contractors are contributing to what could become serious shortages of reclaimed R-22.

“The longer contractors wait to establish an R-22 reclamation program, the more difficult it will be to obtain R-22, and prices will climb as the industry faces an R-22 shortage,” says Tim Wagaman, air conditioning product manager for SPX Corp. SPX manufactures Robinair refrigerant recovery equipment, and is based in Charlotte, NC.

If contractors are recovering R-22, those canisters are gathering dust in a stock room, because many aren’t reclaiming it. Reclamation will help keep the supply where it needs to be, as manufacturers will eventually start cutting back on R-22 production.

“This is something we’re very close to right now,” says Gordon McKinney, vice president, ICOR International, Indianapolis, IN, a manufacturer of alternative refrigerant blends.

“We’re producing a presentation on refrigerant handling, which revisits the ‘three Rs’ — recovery, reclamation, and recycling — to bring everyone up to speed on what’s changed, what we’ve learned over the last decade in regards to the three Rs, and how important it will be over the next few years,” McKinney says.

This latest ICOR tutorial is one of many training programs the company has produced, in light of the move to non-ozone depleting refrigerants. It covers refrigerants, refrigerant handling and service, and other related topics.

McKinney says he’s seen estimates that show the U.S. HVACR service industry uses about 150 million pounds of R-22 refrigerant each year.

“And in two years, that will be cut by about 46%,” McKinney says, as there will be no fresh R-22 to fill the pipeline. “And the only way to fill the pipeline is for more contractors to begin reclaiming R-22, as they convince more customers to install R-410A systems or use new alternatives.

“Some owners will keep their older equipment running as long as they can, and technicians will continue to service it. However, if a contractor is to maintain an existing R-22 system, and do it practically and economically, he’ll have to do so with reclaimed refrigerant, and/or convert the systems over to those that use less costly, accepted refrigerants,” McKinney says.

In September, the parties to the Montreal Protocol mandated that HCFC consumption will be limited to 25% of 1996 levels, versus the originally agreed-upon 35%.

Kevin O’Shea, DuPont’s North American marketing manager for stationary and mobile refrigerants, says the wake of concern related to those tougher restrictions is wafting across the industry.

“R-22 recovery and reclamation is a significant issue across the board, at the manufacturer, wholesaler, and contractor levels,” O’Shea says.

“In the refrigeration sector, for example, roughly 75% of the installed equipment base is comprised of R-22 systems, and the industry is just starting to realize the impact of the accelerated Montreal Protocol deadlines. When you look at the numbers associated with going to 25% of the original cap, the supply picture looks a lot more snug than it did before.”

According to O’Shea, DuPont has been working closely with its distributor network to provide information on the accelerated regulations and their resulting impact on supply, and the growing importance of reclamation and alternative products for retrofits.

“We’ve also worked with a number of supermarkets that have retrofitted over 1,200 large refrigeration systems away from R-22 to DuPont’s ISCEON MO29 (R-422D), with good results,” O’Shea says.

“DuPont and other refrigerant formulators are trying to get the word out to wholesalers, and the contractors they serve, to review where they stand in regard to R-22 today, and what kind of plans they have in place to move away from it. Are they doing something, or still waiting?”

DuPont advises dealers, service contractors, and equipment owners to take action now, including implementing a refrigerant management plan to transition away from R-22. Such a plan should include:

• repairing all leaks, especially since EPA is expected to propose tighter leak limits for refrigeration equipment in Spring, 2008

• retrofitting to alternative refrigerants

• recovering and reclaiming R-22

• recommending new equipment that uses new, non-ozone depleting refrigerants.

History Repeats Itself: Remember R-12?

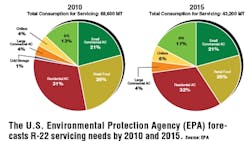

Wagaman says there will be an estimated 75% reduction in R-22 production between 2012 and 2015, and prices will surely climb. “You can equate this with R-12 and R-134A refrigerants, on the automotive side,” Wagaman says. “At that time, there was a shortage of R-12 due to weak reclamation efforts, which drove prices up significantly.”

Another estimate, one that speaks to equipment longevity, and the “repair rather than replace scenario,” says that in 2020, there will be at least 19 million pieces of R-22 equipment in use in the U.S., which is not so far-fetched a figure when you consider what happened during the R-12 elimination.

Dave Jones, president of Atlantic Refrigeration & Air Conditioning, Lewes, DE, recalls the R-12 situation as if it were yesterday.

“When R-12 and R-502 were the main targets, it was very dramatic, when everyone started progressing away from them,” recalls Jones. “R-22 didn’t pose the same chlorine threat to the atmosphere, and was left alone. The drama of the R-12 and R-502 elimination caused skepticism in the air conditioning markets, due to the operating pressures associated with R-410A. Refrigeration contractors took care of their side of things, but air conditioning contractors haven’t made the change to R-410A because they’re so comfortable with R-22.

“I think there’s a real need for education related to R-410A, possibly because in the beginning, information primarily came from one manufacturer, which was Carrier, and was related to their Puron refrigerant,” Jones says. “Non-Carrier contractors didn’t have the same information.”

Jones says contractors need more information on how R-410A compares favorably to R-22.

“I haven’t read a lot that tells me what’s good about R-410A, only that the changeout needs to be done. Contractors need to know that R-410A is no longer a guinea pig, it’s the standard.”

Julius Banks, head of the EPA’s Clean Air Act Enforcement Division, agrees. “Many contractors are aware of the R-22 equipment phase-out, but not all of them understand it. There’s a gap in the R-22 recovery rate that contractors can fill.”

Wagaman suggests more contractors b establish reclamation practices and procedures, either with their wholesalers, or with a reclamation company.

Proper practices include using the proper Department of Transportation (DOT) refrigerant canisters, properly identified.

“Since we’re seeing more blends in the marketplace, it will be more important to know what kind of refrigerant you’re reclaiming,” Wagaman says.

Remember: Proper Handling is Law

Craig Thomas, marketing manager for refrigerants in North America for Arkema, a worldwide refrigerants producer with a U.S. base in Philadelphia, PA, says contractors can’t lose site of the legal ramifications of undisciplined refrigerant management.

“There are laws in place related to refrigerant reclamation, so there’s a definite legal aspect that contractors can’t ignore,” says Thomas, “and we recommend that contractors follow the law.” (See sidebar on Sec. 608 of the Clean Air Act of 1990.)

“Beyond that, the gradually rising cost of R-22 should help spur reclamation activity. As the cost for R-22 has increased, the reclamation process has gained in importance,” Thomas says.

Included in Arkema’s efforts, are publications for wholesalers related to the phase out of HCFC refrigerants, and a review of the company’s entire refrigerant education regimen.

“Our reclamation program is being improved, to be more wholesaler friendly, and we’re offering educational programs through our wholesalers; we try to keep contractors in mind, as the ultimate end-users,” Thomas says.

Distributors can also play an important role, as Jones’s story shows. During the historic R-12 elimination, Jones established a program with his distributor, United Refrigeration, for walk-in refrigeration compressor failures.

“They did a really good job of giving us quick turnaround on R-22 equipment, and helping us make the switch to R-22,” Jones says. “We instituted a ‘stop now’ policy, which kept us looking away from R-12.”

Get Ahead of the Curve

What should contractors do now to avoid R-22 supply issues later, and help the industry jump this hurdle more easily? Just get started, and follow proper procedures.

“We urge contractors to practice good recovery skills so they’re not contaminating refrigerants, and pair themselves up with a wholesaler and/or reclamation facility that can clean, test, recertify and bottle that refrigerant, and give it back to them. This will lower their cost for virgin R-22, if they cost average,” says Ken Ponder, owner of RMS of Georgia, a manufacturer of alternative refrigerants, and an EPA-certified reclamation facility, based in Alpharetta, GA. One of the company’s newest refrigerants — R-421A — can be used to replace R-22 in multiple applications, without unit modifications.

McKinney says price could eventually be the best motivator for contractors to get up to speed before the 2010 deadline.

Beyond higher prices, McKinney says those contractors who have become more active in recovering and reclaiming refrigerant are just trying to get ahead of the curve. Others are concerned about EPA scrutiny of their businesses, and possible fines of up to $32,500/day for non-compliance with Sec. 608.

“We’re not surprised that the alternatives to R-22 aren’t running at the speed we’d all like them to be. However, they’re definitely gaining notoriety,” Ponder says, realilzing that contractors often receive conflicting information from a host of entities.

“Bottom line, it boils down to price,” Ponder adds. “The alternatives to R-22 are still two-anda- half times less than the cost of existing R-22. So every day we move closer to 2010, that price will continue to escalate, and shorten the gap between an alternative and the gas it’s replacing.

“And start looking at the alternatives to R-22. They’re here to stay. They’re long-term replacements for change, and it’s too early to tell which will be the first, second, or third alternative to R-22.”

| Accepted R-22 Replacements: a Partial Listing • NU-22 is ICOR’s R-22 replacement compatible with equipment components and oils used in R-22 systems. The product has been improved in the form of NU-22B, which ICOR says offers even closer operating characteristics, additional capacity, and overall improved performance. In addition to R-22, NU-22B is used instead of R-407C and R-417A. ICOR’s One Shot (C) is a non-ozone-depleting HFC blend that replaces R-502 and R-22 in medium and low temperature applications. It can also be used instead of R-402A, R-402B, R-404A, R-408A and R-507A. • DuPont’s ISCEON MO29 is a non-ozonedepleting HFC refrigerant for replacing R-22 in medium-temperature direct expansion (DX) refrigeration applications (can also be used for low temperature), including commercial supermarket systems, and stationary DX air conditioning applications, including DX water chillers. ISCEON MO79 is a non-ozone-depleting HFC refrigerant for replacing R-22, R-502, and HCFC-containing refrigerant blends in medium- and low-temperature commercial and industrial direct expansion refrigeration systems. • For commercial refrigeration, Arkema provides Forane 134a, Forane 404A and Forane 507 for use in new applications. Forane 407C, a refrigerant blend of HFC-32, 125 and 134a has thermodynamic and performance properties similar to R-22. Although Forane 407C’s properties are comparable to R-22, the overall performance is slightly less than R-22 in similar applications. Forane 410A, a refrigerant blend of HFC-32 and 125, is being used by some original equipment manufacturers as the refrigerating fluid in their newest units. • RMS of Georgia provides alternative gas and refrigerant blends, including its own Choice R-420A, Choice R-421A, Choice R-421B, Quick Change R-134a, and R-417A refrigerant gases. |

About the Author

Terry McIver

Content Director - CB

As director of content for Contracting Business, he produces daily content and feature articles for CB's 38,000 print subscribers and many more Internet visitors. He has written hundreds, if not two or three, pieces of news, features and contractor profile articles for CB's audience of quality HVACR contractors. He can also be found covering HVACR industry events or visiting with manufacturers and contractors. He also has significant experience in trade show planning.