Sage Survey of Small and Midsized Businesses Finds Cautious Optimism at Work

As America’s small and midsized businesses continue to weather economic uncertainty and rising business costs, many are keeping tight reins on hiring. Only a quarter of businesses with one to 500 employees surveyed recently by Sage North America have increased or plan to increase the size of their workforce in 2013, and nearly half plan to keep it the same.

According to Sage’s survey, the hiring outlook is best in companies with more than 100 employees, with half planning to increase the size of their workforce this year. A third of companies with 20-99 employees plan to add to their workforce, and just 18% of companies with one to 19 employees plan to expand.

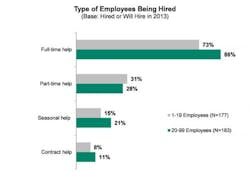

Fortunately, layoffs are not in the works for most; less than 10 percent of all small and medium businesses surveyed plan to decrease workforce size in 2013. Moreover, across the board, small and medium businesses that plan to hire will offer permanent positions, with 82% looking for full-time help and 29% seeking part-time employees.

According to Sage’s survey, the hiring outlook is best in companies with more than 100 employees, with half planning to increase

the size of their workforce this year.

This year’s outlook may be only slightly better than last year’s as small and midsized businesses continue to proceed with caution. Among companies that hired in 2012, 43% of those with 20-99 employees plan to increase hiring compared to 2012, and 47% plan to stay the course. Just over 40% of companies with one to 19 employees plan to add more to their workforce this year than last; 46% plan to keep it the same. The outlook is better in larger companies —more than half of those with 100 or more employees plan to hire more people this year than last, while 30% plan to keep hiring levels the same.

While the government’s report showed that manufacturing employment was unchanged in April, nearly a third of small to midsized manufacturing firms surveyed expect to increase the size of their workforce in 2013. About half plan to keep it the same. More than one in three Americans who work in manufacturing work at a small to midsized business.

When respondents who planned to increase the size of their workforce in 2013 were asked about the factors influencing their hiring decisions, more than 83% of all businesses surveyed cited a stronger demand for their company’s products and services. About a third said an improved economic outlook helped drive the decision.

The outlook was less favorable for respondents who planned to decrease their workforce size or keep it the same. Forty percent said demand for their products or services was steady or weakened, and expressed uncertainty about the economy. Health care costs and the Affordable Care Act were cited by more than a third of businesses with more than 100 employees, and nearly a quarter with 20-99. The costs of doing business (other than health care) were an issue for 31% of the 20-99 group, and 26% of the smallest businesses.

Until small and midsized businesses feel more confident about the future, hiring is likely to be slow. Economic uncertainty and the costs of doing business are making it more important than ever for small and midsized business manufacturers to streamline their operations and take advantage of technology and tools that help them run smarter, more cost-effective businesses. That may mean finding ways to cut costs, such as reducing fees, automating manual tasks where possible, and taking advantage of new technology that streamlines time-consuming functions such as payment processing and accounting integration.

The survey was conducted by Sage in May 2013, and the margin of error is +/- 3 percent with a confidence level of 95%.