I recently spoke with a former CEO of one of the seven major HVAC manufacturers. I told him that for years I have been telling contractors that 5 percent of all HVAC contractors earn 95 percent of all the profit earned in our industry. He said, “Bill, I think it’s worse than that!”

He then said, ”since 5 percent of the HVAC contractors are earning 95 percent of the industry profit and becoming wealthy, that means 95 percent of all contractors are working hard and splitting up the remaining 5 percent of profit!”

It has been estimated that there are about 80,000 HVAC contractors in the United States. Using that 80,000 estimate, the math works this way; 4,000 contractors are getting rich and the other 76,000 contractors are barely getting by, and some of them are failing or scrambling just to survive.

95 PERCENTERS price to get jobs because they need to keep cash flowing to pay bills they have already incurred. The mindset is, “We need to get the job!”

If the top 25 HVAC business trainers and consultants were asked, what is the most pressing contractor problem in our industry? Their answers would vary, but they would all agree that because most contractors are un-informed about business, we have an industry pricing problem.

The methods of pricing used by the “95 percenters” have little or nothing to do with covering overhead or desired profit. They price to get jobs because we need to keep cash flowing to pay bills they have already incurred. The mindset is, “We need to get the job!”

It’s fair to say that our competition’s price is controlling our selling price.

The 95 percenters price installations and services to get jobs with this process. The thinking goes like this:

• I must be doing well because I have money in the checkbook.

• I am selling lots of jobs and our customers love us.

• Maybe I should to hire more people because we have so much work,

• Thinking about buying a new truck, our accountant even suggested it, so we could avoid paying taxes. I figure he knows what he is talking about with all those diplomas, so must really know his stuff, everything about business. He wouldn’t steer me wrong. I can’t wait to see the look on my dumb competitors’ faces.

• The accountant also suggested that it would be better for me to not pay myself a regular paycheck, and that if I needed money, I could just take it from something called a cash disbursement. I think it’s a tax thing… I just love being a businessman.

• I'm thinking about buying my wife a really nice new car because business is so good right now.

• All I have to do is just keep this ball rolling; you know, “get the next job.”

. . . And on and on it goes.

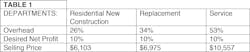

The “5 percenters” know the connection between their department overheads, desired net profits and how they price goods and services in each department.

The most serious mistake, is that direct labor costs are shown as part of the general overhead expense rather than as a cost of sale on the profit and loss statement.

From my experience very few 95 percenters know their correct total company overhead. And it’s because their accounting is inaccurate. The most serious mistake, is that direct labor costs are shown as part of the general overhead expense rather than as a cost of sale on the profit and loss statement. There are many other examples.

All 5 percenters know that direct labor is a cost of the sale.

Advice: I estimate that 90 percent of contractors use QuickBooks, and that QuickBooks right out of the box is not organized for the contracting business. Contractors must reorganize the standard QuickBooks chart of accounts to fit our contracting business. It’s not hard to do, but it’s definitely necessary to do!

To calculate the right selling price for your company, you must know these 7 basic procedures:

1. How to calculate the owner’s annual “needed hourly pay.”

2. How to correctly estimate the cost of a sale.

3. How to job cost all installations and service invoices

4. How to re-structure your chart of accounts on profit and loss statement

5. How to forecast and calculate your company business expenses.

6. How to forecast and calculate your monthly cash flow expenses.

7. How to departmentalize your business.

a. Sales by department?

b. Department Gross profit/gross margin percentages?

c. Department Overhead expenses?

d. Department Net profit for each?

If you answered ‘yes’ to those procedures, congratulations, you may very well be a “Five Percenter” or certainly on the way to becoming one. If you answered no to one or more of those questions, you are probably in the 95 percent group.

Consult Your Accountant

Accountants are tax experts and we hire them to calculate our tax liability. From my personal experience accountants almost never volunteer information. Please talk to an accountant and ask for advice. Contractors must learn the important questions to ask, because their financial life depends upon it.

Departmentalizing Your Business

When you departmentalize your company, you divide its forecasted overhead into departments.

My guess is that 95 percent of contractors do not departmentalize their business. Contractors don’t departmentalize because, either they don’t know how or don’t realize just how necessary departmentalization is when calculating your “right” selling prices.

Personal Story: I was one of those 95 percenters. Because I had no idea of how to departmentalize or why I should, I just dumped all our sales into one big sales barrel. For example, I had no clue what my service sales were, or which part of my business was making or losing money. After departmentalizing, I learned that I was losing my shirt in the service business and even more in the residential new construction business. My replacement business was barely keeping me afloat.

If you don’t learn your overhead by department, then you’ll be doomed forever to have the competition setting your price. You must know the overhead in each of those in-house businesses so your sales price will cover those department overheads and your desired net profits. Your only other option is to use industry KPI’s or keep on doing what you’re doing! See Ligon’s Law at the end of this article.

Key Performance Indicators

The overhead KPI in a typical replacement department is between 30-40 percent of sales. In a typical service department, the overhead KPI ranges between 45%-60 percent of service sales. If those percentages surprise and cause you to worry it’s understandable, because you can imagine how this wide difference in overhead percentages would affect pricing. Guessing that your service overhead percentage is 45 percent. Pricing with that guess, when it actually is 55 percent, is like playing Russian roulette, and could result in a financial disaster.

How to Departmentalize

Departmentalizing forecasted overhead into departments is not an exact science, but it’s far better than a guess. Because if you revisit your expense forecast monthly and make monthly adjustments it is very accurate! Direct labor is defined as employees and owners that work with tools to install or service. Direct labor is the principle source of overhead expense in the contracting business! Therefore, using the percentage which each department actually pays in direct labor is an accurate way to allocate overhead. NOTE for the owner: selling, estimating and checking the progress of a job is NOT direct labor!

How to Allocate Overhead Expenses into Departments

1. Assign a percentage of direct labor for each employee that works with tools to service or replace equipment in each department.

For example: the service technician may spend 65 percent of his time doing service, 17.5 percent doing start-ups in new construction, and 17.5 percent installing replacements. You must repeat this exercise (assigning a percentage to departments) with all direct labor employees.

2. Add up all the annual direct labor dollars for each department.

3. Add up the total of all departments direct labor dollars.

4. Divide total labor dollars in each department by the total of all direct labor dollars to get a department percentage figure.

5. Multiply each overhead expense (rent, insurance, utilities, etc.) by the department percentages.

THE DIVISOR METHOD OF PRICING

Your Estimated Cost of the Sale for this Residential New Construction job is $3,906

Res. New Construction Department Forecasted Overhead = 28%

Res. New Construction Department Desired Net Profit = 8%

1. Add Percentages together. 28% + 8% = 36%

2. Subtract the 36% from 1.0 (1 - .36 = .64)

3.The Divisor for this Residential New Construction. Department is .64

4. Divide Cost of the Sale $3,906 by the Divisor .64 ($3,906/.64)

5. This Equals the Right Price of $6,103

You recovered 100% of cost of the sale, 100% of overhead and 100% of your desired net profit.

Desired Net Profit of 10%

Cost of the Sale = $3,906

The desired net profit is the same for all three departments. This illustrates the importance of knowing Department Overhead Percentage

He has been helping hundreds of contractors improve their businesses since 2000.

He can be reached at 501-922-7594