In its March 2022 issue, Contracting Business included an article entitled, "Why HVAC Private Equity Will Crash and Burn." The article was written by a long-time industry veteran and current President of Service Nation, Matt Michel. The article comes down hard on private equity investment in the HVAC industry and while history does point to potential for failure, the article jumped to some conclusions that need a closer examination.

Let’s focus on an important underlying premises of the article. Michel writes “There are too many players chasing too few contractors. Not all of them are major players, but 20 is too many. Ten is too many. Either P.E. firms will target outside of residential service and replacement market as consolidators did in the 1990s, and start buying weaker companies; or some, followed by others, will start to abandon the industry.” The article references residential consolidation, but the overall critiques are common for both commercial and residential private equity investment so we will focus on both.

This scarcity premise is an important one as it strikes at the core of the private equity playbook. While scale isn’t the only value consolidators provide, it is a major aspect of their investment strategy. So, are there in fact too many consolidation efforts chasing too few contractors? My answer to that question is A) It’s a big marketplace, and B) It’s quality over quantity that matters.

It’s a Big Marketplace

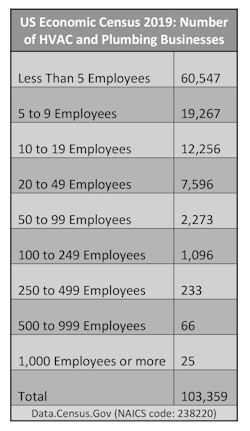

According to US Census data, there are 103,359 HVAC and plumbing contractors in the US. The census doesn’t’ break out plumbing separately but let’s assume two thirds of those are HVAC contractors. That’s 69,250 HVAC contractors.

The census does break down contractors by number of employees (see table below). Private equity firms tend to buy companies in the 20 employees to 250 employees size range which brings us to a total of 10,965 HVAC and plumbing contractors, and two-thirds of that is 7,314 HVAC contractors. That’s a lot ofA consolidator would likely see their efforts as quite successful if they were able to purchase 20 to 30 contractors and for our example, we’ll use the higher number. With 50 consolidators purchasing 30 companies each, that would be 1,500 contractors being acquired, or 20.5 percent of the market. That's a significant chunk of the market, but far from indicating that there aren’t enough potential acquisitions to fuel consolidation.

Quality Over Quantity Matters

To an extent these numbers address the scarcity premise, but there are certainly gaps in the analysis. It’s difficult to say how many quality contractors make up the marketplace or how many of those businesses may be available for purchase by consolidators. So that begs the question, what is the fallout IF consolidators run out of quality contractors to purchase? Will they in fact crash and burn?

The short answer is maybe. The potential failure point for consolidators isn’t in how many contractors they can purchase but their discipline in purchasing quality contractors. To his credit, Matt Michel references the importance of quality but then quickly leaps to the assumption that all consolidators will be undisciplined in their approach and will buy “weaker companies.”

Given the number of acquisition headlines in the past few years, one could assume that consolidators currently have low standards for quality or that it will trend that direction soon. My experience as a broker leads me to believe that isn’t necessarily the case. I am frequently in contact with consolidators about HVAC companies for sale only to hear a response along the lines of “that business doesn’t meet our criteria” or “it’s not in line with our current strategy.”

So, what will become of a disciplined consolidator IF there ends up being a lack of quality companies to buy? A crash and burn scenario seems unlikely. It’s far more likely that the private equity firm will simply wind up exiting their investment by selling to another consolidator or another large company. As the old saying goes, “there will always be a market for quality.” But there’s also another old saying, “history tends to repeat itself” which just might be the case for undisciplined consolidators repeating the crash and burn scenario.

About the Author

Peter Flippen

HVAC Exit and M&A Advisor

Peter Flippen is an HVAC Exit and M&A Advisor for IEI Advisors, Richmond, Va.